Mastering the Art of Trading Pocket Option A Comprehensive Guide

Mastering the Art of Trading Pocket Option A Comprehensive Guide

Mastering the Art of Trading Pocket Option

In the fast-paced world of financial markets, mastering Trading Pocket Option trading Pocket Option requires a combination of skill, strategy, and psychology. This article will delve into the essential aspects of trading on this platform, offering insights that can help both novice and experienced traders succeed.

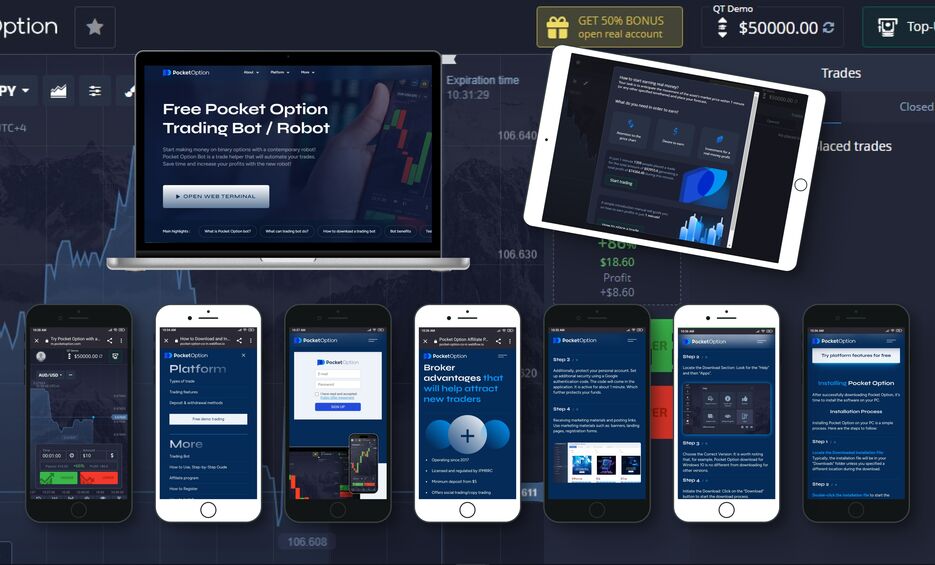

Understanding Pocket Option

Pocket Option is an innovative online trading platform that has gained immense popularity for its user-friendly interface and a wide range of financial instruments. It allows traders to engage in various types of trading, including binary options and digital options. The platform is designed to cater to both beginners and advanced traders alike, making it accessible for anyone looking to make a profit in the trading world.

Getting Started with Pocket Option

To begin your journey on Pocket Option, you first need to create an account. The registration process is straightforward, requiring only basic personal information. Once you’ve signed up and verified your account, you can deposit funds using various payment methods, including bank transfers, credit cards, and cryptocurrencies.

It is advisable to start with a demo account. This feature allows you to practice trading with virtual funds, helping you to familiarize yourself with the platform without risking real money. Use this opportunity to experiment with different trading strategies and understand how various assets perform under different market conditions.

Choosing the Right Strategy

Success in trading Pocket Option heavily depends on your choice of trading strategy. Traders can employ various styles, including scalping, day trading, and swing trading. Scalping involves making quick trades to exploit small price changes, while day trading typically focuses on opening and closing positions within the same day. Swing trading, on the other hand, involves taking advantage of price movements over several days or weeks.

Each strategy has its advantages and disadvantages, and your choice should reflect your risk tolerance, time commitment, and trading psychology. For example, if you only have a few hours each day to monitor trades, day trading might not be suitable for you. Consider your lifestyle and preferences before deciding on a strategy.

Technical and Fundamental Analysis

Traders on Pocket Option should familiarize themselves with both technical and fundamental analysis methods. Technical analysis involves studying price charts, indicators, and patterns to forecast future price movements. Traders often use tools like moving averages, RSI (Relative Strength Index), and Bollinger Bands to help identify entry and exit points.

On the other hand, fundamental analysis requires knowledge of economic indicators, news events, and market sentiment. It is crucial to stay updated with financial news, as events such as interest rate changes, earnings reports, and geopolitical tensions can significantly impact asset prices.

The Importance of Risk Management

Risk management is an essential aspect of trading that should not be overlooked. Successful traders understand the importance of preserving their capital and minimizing losses. One effective way to manage risk is to set stop-loss orders, which automatically close a trade at a predetermined price level, preventing further losses.

Additionally, it’s crucial to define your risk per trade. Many experienced traders advise risking no more than 1-2% of your trading capital on a single trade. This approach helps to ensure that you can withstand a series of losing trades without depleting your account.

Building a Trading Plan

A well-structured trading plan is vital for achieving consistent profitability. Your trading plan should outline your goals, preferred trading strategies, risk tolerance, and rules for entering and exiting trades. By adhering to your plan, you can avoid emotional decision-making, which is one of the leading causes of losses in trading.

Regularly reviewing and adjusting your trading plan is also crucial. The financial markets are dynamic, and what works today may not work tomorrow. Be prepared to adapt to changing market conditions and refine your strategies accordingly.

Emotional Discipline and Trading Psychology

One of the most significant challenges traders encounter is managing their emotions. Fear and greed can cloud judgment and lead to poor decision-making. Implementing strategies to cope with these emotions is crucial to develop as a trader.

Practicing mindfulness techniques, setting realistic goals, and maintaining a journal to reflect on your trades can help you cultivate emotional discipline. Remember that losses are a part of trading, and learning from them is essential for long-term success.

Utilizing Pocket Option Features

Pocket Option offers various features that can enhance your trading experience. For instance, the platform provides access to a wide range of assets, including forex, cryptocurrencies, commodities, and stocks. You can also use advanced trading tools like signals and copy trading, which allows you to mimic the trades of successful traders.

Additionally, take advantage of the platform’s educational resources, webinars, and tutorials to improve your trading skills. Continuous learning is essential in the trading world, and Pocket Option provides ample opportunities for you to expand your knowledge.

Conclusion

Trading Pocket Option can be a rewarding venture if approached with the right mindset and strategies. By understanding the platform, choosing the right trading strategy, mastering analysis techniques, managing risks effectively, and maintaining emotional discipline, you can enhance your chances of success in the financial markets. Remember, trading is a journey, and continuous improvement should be your ultimate goal.